Money decisions aren’t just about numbers on a spreadsheet. They’re about psychology, identity, and how we want others to see us.

Nowhere is this more obvious than in the world of “status” purchases—the things we buy not because we need them, but because they signal something about who we are.

For most people, these purchases are tempting. They promise belonging, admiration, or proof of success. But the truth is, avoiding them often reveals a kind of quiet financial wisdom.

If you’re resisting the pull of status-driven spending, you’re likely making choices that will serve you far better in the long run. Here are seven common status purchases that, if you’re avoiding them, put you ahead of the pack.

1. The luxury car upgrade

A brand-new luxury car is one of the most obvious status symbols out there. The sleek design, the badge on the front, the way it makes you feel as you pull into the driveway—it’s a purchase people often justify as a “reward” for success.

But financially savvy people see cars for what they are: depreciating assets.

The moment you drive a new car off the lot, it loses value, and luxury models drop faster than most. Unless you’re genuinely passionate about cars, sinking tens of thousands into one is a quick way to weaken your financial footing.

When you stick with a reliable, less flashy vehicle—or keep your current car for as long as it runs—you’re signaling something important: that your financial stability matters more than impressing strangers at traffic lights.

2. Designer wardrobes

Here’s a question: how much of our clothing is about function, and how much is about signaling status?

Designer labels promise exclusivity, but most of us know they don’t necessarily deliver better quality. What they really sell is the idea of being seen as fashionable, affluent, or “in the know.”

I once had a friend who maxed out credit cards chasing every new designer drop. He looked sharp, sure, but he also carried a heavy burden of debt that quietly chipped away at his sense of freedom. His wardrobe was enviable, but his stress levels weren’t.

Financially savvy people recognize that style doesn’t require a logo. They buy clothes that last, pieces that fit their life, and they resist the pull of needing to be seen in whatever’s trending. Over time, that approach adds up to more savings and less pressure.

3. The “dream” house that stretches your budget

For many people, the house is the ultimate status purchase. Bigger, newer, more impressive—it’s easy to believe that the right home proves you’ve “made it.”

But there’s a difference between a home that supports your life and one that becomes a financial strain.

Psychologists talk about the hedonic treadmill—the idea that we quickly adapt to whatever new thing we acquire, and then start wanting more. A bigger house feels great at first, but soon enough, it becomes the new baseline. Along with it come higher bills, more maintenance, and often, more stress.

If you’ve chosen a home that’s comfortable but not a stretch, you’re showing real wisdom. You’ve prioritized financial flexibility over appearances, and that flexibility gives you options—whether it’s traveling, investing, or simply enjoying a less pressured lifestyle.

4. The latest tech gadgets

I’ll admit: I’ve been guilty of this one. When the latest phone model dropped a few years ago, I convinced myself I needed it.

My old phone worked fine, but the marketing and the buzz got to me. A week later, I was looking at my bank account thinking: “Did that really make my life better?” Spoiler: it didn’t.

Tech companies are masters of creating artificial urgency. They convince us that last year’s perfectly functional device is suddenly outdated. But financially savvy people step back and ask: does this upgrade solve a real problem for me, or am I just chasing status?

Holding onto your devices until they truly need replacing might not feel glamorous, but it’s smart. It keeps your money in your pocket and reminds you that usefulness matters more than novelty.

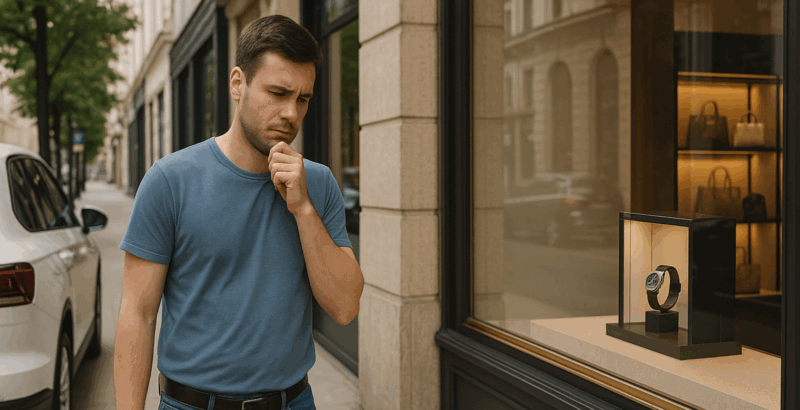

5. Extravagant jewelry and watches

Jewelry and watches often fall into the category of “social proof.” They tell the world you can afford luxury, even if the people noticing you will never be part of your inner circle.

The irony is that most of the admiration these items generate is fleeting. People might compliment your watch or necklace once, but then they move on. Meanwhile, you’re left with the bill.

If you’ve resisted dropping serious money on these shiny symbols, you’ve already sidestepped a major financial trap. You’re investing in things with real value—whether that’s experiences, education, or simply the peace of mind that comes with keeping your finances steady.

6. Exclusive club memberships

Do you ever feel the pull to join something because of who else will be there? Country clubs, high-end gyms, or exclusive “networking” memberships often promise access and prestige.

But for many people, they become expensive status props more than practical investments.

I had a colleague who signed up for an elite gym in the city, paying hundreds every month. The problem? He barely went. He admitted later that the membership was less about fitness and more about being associated with a certain kind of crowd.

Financially savvy people ask a simple question: does this purchase add real value to my life? If the answer is no, they don’t bite. That discipline means their money isn’t tied up in appearances—it’s working for them in smarter ways.

7. The flashy vacation

We’ve all seen it: the Instagram-perfect vacation filled with luxury hotels, designer luggage, and staged beach photos. Travel can absolutely be enriching, but when it’s done primarily for show, it becomes another status purchase.

Here’s the irony: people often return from these trips financially strained and sometimes more stressed than before. The memories may be real, but the financial hit can linger long after the tan fades.

Choosing more modest trips—or traveling in ways that prioritize meaning over spectacle—shows a kind of maturity.

Financially savvy people know that you don’t need a five-star resort to have a five-star experience. It’s about who you’re with, what you learn, and how you feel, not the price tag on the hotel.

Final thoughts

Status purchases are tempting because they promise validation. They whisper, “If you buy this, people will admire you.” But admiration built on what you own is fleeting, while the financial strain can last for years.

When you resist these purchases—whether it’s the luxury car, the oversized house, or the newest phone—you’re not depriving yourself. You’re proving that you value freedom over appearances. And that freedom is the ultimate status symbol.

If you’re already avoiding most of these, take it as confirmation: you’re thinking smarter about money than most people.

- People who still look young in their 60s and beyond usually adopt these 8 daily habits - September 22, 2025

- Psychology says people who are naturally kind but have no close friends often display these 7 traits - September 19, 2025

- People who stay joyful in their 70s almost always share these 7 traits - September 18, 2025